Why ESG investing needs standards?

- With the rapid growth of ESG-focused investing, investors are often confused by a company’s ESG policies, reporting structures, and results. To verify ESG claims, we must create clear standards and universal practices for ESG reporting.

- The ESG-driven investment will exceed $53 trillion by 2025. 90% of millennials report that they want their money in sustainable investments.

- In 2021, the SEC issued a risk alert detailing observations of ESG-related deficiencies and problems related to investment advisors and funds making ESG claims.

Updates about ESG standards

|

July 2024

June 2024

May 2024

April 2024

March 2024

February 2024

January 2024

December 2023

November 2023

October 2023

September 2023

August 2023

July 2023

June 2023

May 2023

April 2023

March 2023

February 2023

January 2023

December 2022

November 2022

October 2022

September 2022

August 2022

July 2022

June 2022

May 2022

April 2022

March 2022

February 2022

January 2022

December 2021

November 2021

October 2021

September 2021

August 2021

July 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

|

ESG Research References

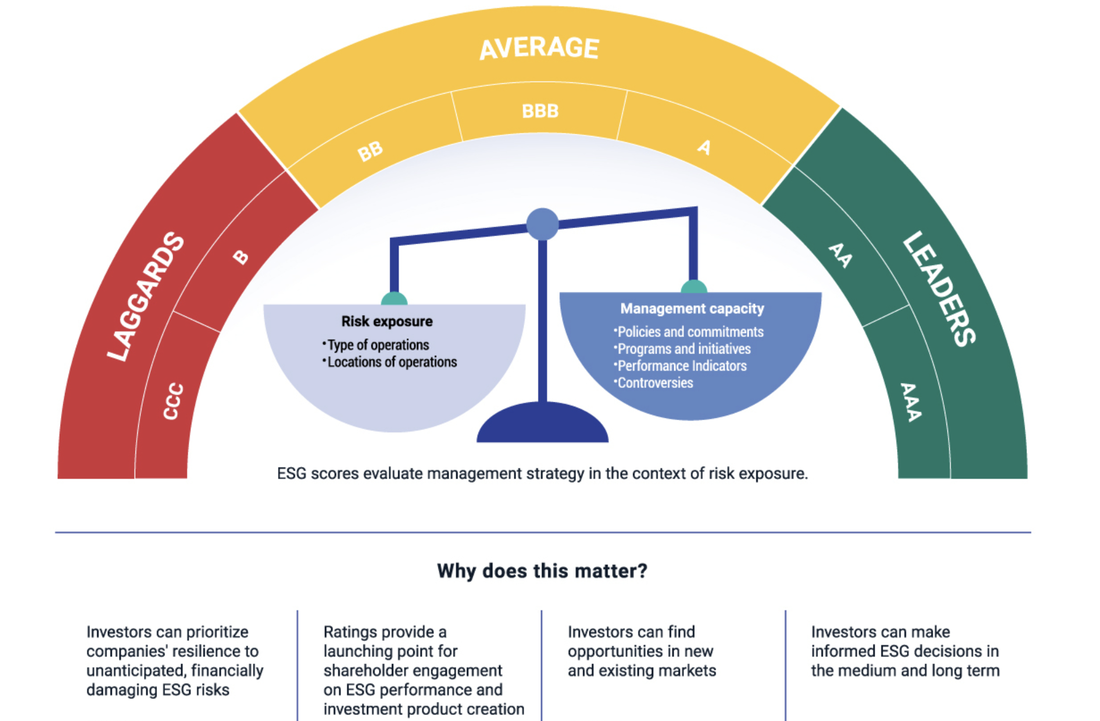

- Inside ESG Ratings: How Companies are Scored (2021)

- ESG Ratings and Data: How to Make Sense of Disagreement - Paul Weiss (2021)

- Stock Price Reactions to ESG News: The Role of ESG Ratings and Disagreement - Harvard Business School (2021)

- ESG Ratings: The Road Ahead - Milken Institute (2020)

- ESG rating disagreement and stock returns - Inrate AG (2020)

- ESG Investing: Practices, Progress and Challenges - OECD (2020)

Importance of ESG standards

|

Welcome to ESGStandard.com, a free online resource dedicated to standardizing environmental, social and corporate governance (ESG) metrics and ESG investing.

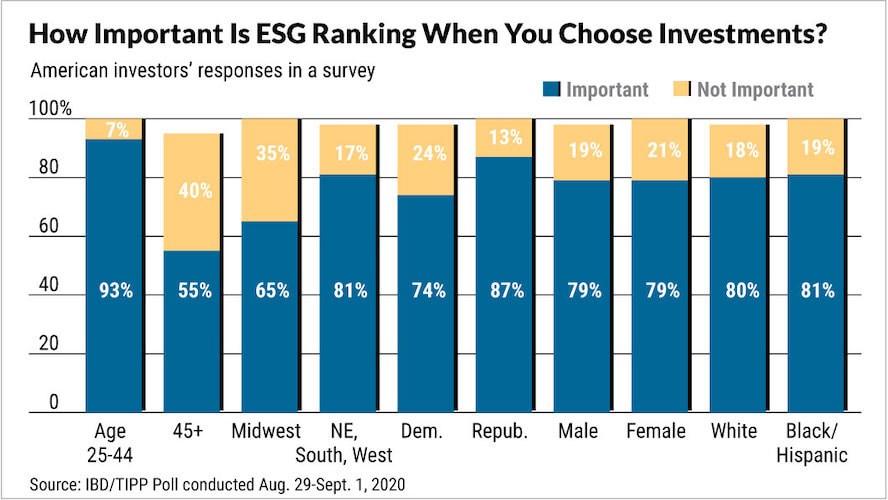

ESG investing has become a popular concept. Yet relatively few American investors are familiar with what is ESG and how to make better ESG investing. According to the CFA Institute, there is no standardized approach to calculate or present different ESG metrics. Investors can employ any selected analytical approaches and data sources to address ESG considerations, including weighting to client interest and potential value. Surprisingly, new research shows that some ESG funds have voted against environmental and socially conscious resolutions. Many ESG investors today have experienced that existing data on sustainability issues are bad quality or inconsistent, which increases the difficulty of comparisons between companies. I believe understanding the relative merits and limitations of different metrics is necessary to help form a complete picture of ESG risks and opportunities.

The financial industry’s growth can only be sustainable by adding measurable value when serving investors. Please contact us about our ESG standard training and consulting services to identify and re-engineer inferior ESG products and services, commonly seen at many financial firms today. Through better standard and technology applications, our forefront research yields better results in performance improvement, cost savings, risk reduction, behavioral measurement, and standard benchmarking.

|